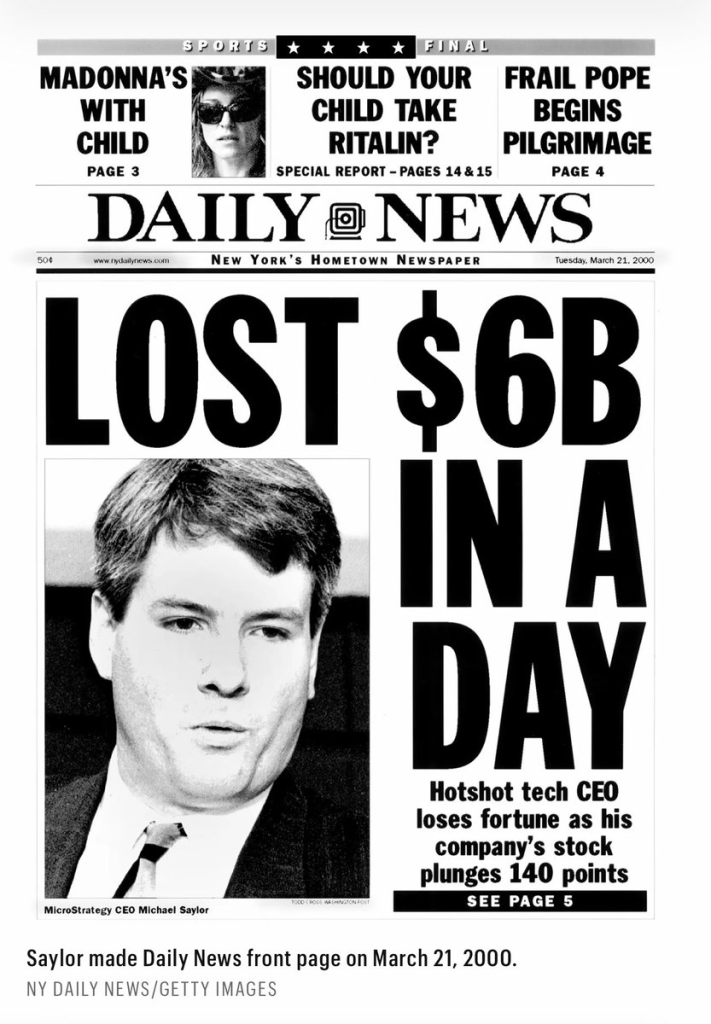

Michael Saylor’s Previous $6B Vanishing Act Should’ve Been a Warning

Michael Saylor didn’t just lose $6 billion in a day back in March 2000 — he lost the credibility of an entire generation. Yet here we are again, watching history rhyme with the next generation applauding on crypto Twitter.

Let’s Rewind

MicroStrategy’s stock collapsed 62% on March 20, 2000, after Saylor announced a restatement of earnings. Why? Because the company falsely claimed profits when it had, in fact, been losing money.

The SEC found him guilty of accounting fraud in 2001. No jail time though. Just a slap on the wrist: $350,000 in fines and $8.3 million in personal paybacks. Pocket change.

The Rhyme

Fast-forward to the present, and Saylor is once again the face of financial “innovation.”

His company, MicroStrategy ($MSTR), has been aggressively leveraging toxic convertible debt to buy billions in Bitcoin. But where’s the on-chain proof of reserves? Still waiting. Saylor talks sovereignty and transparency—yet offers neither.

Lucky for him, his new crop of bagholders weren’t even born when he scammed the last group.

They know him not as the dot-com clown prince, but as Bitcoin’s “visionary.” A visionary who diluted shareholders, borrowed billions, and tied his corporate future to one of the most volatile assets on Earth.

Reality Check

$MSTR’s recent price action isn’t bullish—it’s the beginning of wave (c) of a five-wave correction. These are the exact mechanics of a leveraged collapse. This is what it looks like when toxic bonds implode. This is 2000 in slow motion.

Wall Street memory is short. Retail memory is nonexistent.

Saylor lost $6B in a day before. This time, it could be $60B.

The most frustrating part: CT will hail him as a genius all the way down.

For more: