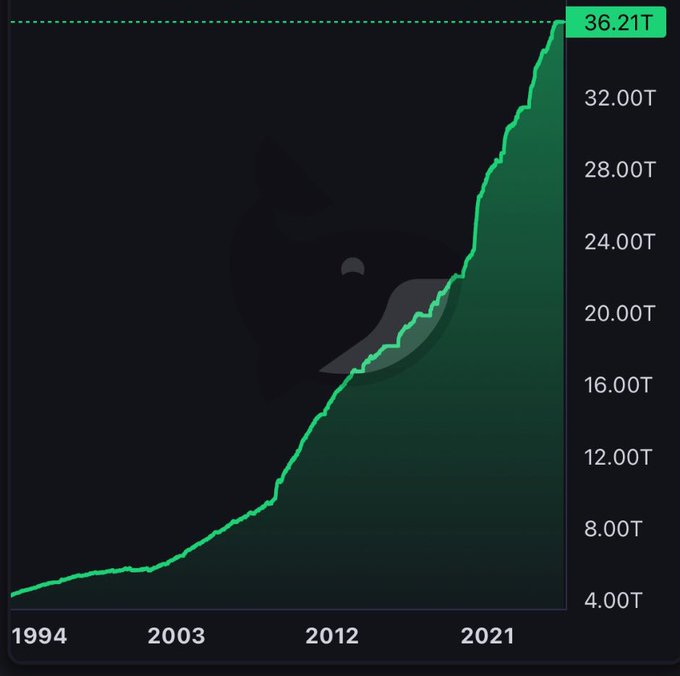

The $36 Trillion Time Bomb: “Scary”

This is not Apple. Not Tesla. Not Nvidia. It’s the U.S. National Debt — and it’s charting like the next meme coin moonshot about to blow.

Since 1994, the curve has been steep. But post-2020, it’s gone vertical.

The U.S. government now owes $36.21 trillion. The pace is accelerating, not slowing. In fact, America added $1 trillion in just three months. At this rate, debt is growing faster than GDP, tax revenues, or even the Fed’s excuses.

Elon Musk today called it “scary.” That’s putting it mildly.

What Happens When the World’s Reserve Currency Becomes a Joke?

The U.S. has long relied on the dollar’s reserve status to kick the can down the road. Print more, borrow more, inflate it away. But the world is catching on.

BRICS is building an alternative. Foreign demand for Treasuries is cooling. And the Fed is caught between saving the bond market or the economy. It can’t do both. In truth, it can’t do either — whichever it chooses, the other won’t be far behind.

Meanwhile, interest payments on the debt are exploding. In 2024, they surpassed defense spending — and soon they’ll outpace Medicare. America is borrowing money just to pay interest on borrowed money.

This isn’t sound policy.

There Is No Exit

Of course, there is no political will to stop this. Neither party has a plan. The “debt ceiling” is a meme. Spending is the addiction. And every “solution” — whether it’s Modern Monetary Theory or higher taxes — is just more gasoline on the fire.

The real cost? Your savings, your purchasing power, your future.

This isn’t fearmongering. This is math. Or I guess technically it’s both.

The chart looks like a launch. But it’s not a rocket — it’s a warning flare. And when the music stops, it won’t be the billionaires who pay the price. It’ll be everyone holding the bag in dollars.