The Case Against Bitcoin

Yes, Bitcoin is in an uptrend. Yes, some people are getting rich—again. But so did plenty of people in 1999, right before the dot-com crash vaporized $5 trillion in market value.

Uptrends don’t prove value. They prove speculation.

Let’s look at the data.

- Volatility: Bitcoin’s 30-day volatility has historically averaged 4–5x that of gold and the S&P 500. That’s not a “store of value.” That’s a slot machine.

- Ownership: The top 2% of Bitcoin addresses control over 95% of supply. This isn’t decentralization—it’s an oligarchy. Price is driven by whales, not retail.

- Usage: Less than 2% of Bitcoin transactions involve actual payments for goods or services. It’s not being used as money—just traded like a hot potato.

- Energy Use: Bitcoin consumes more electricity than Argentina. For what? A slow, clunky network that processes about 7 transactions per second—roughly what even Visa handles in a millisecond.

And let’s not ignore the ETF pump.

Wall Street isn’t embracing Bitcoin because they believe in decentralization. They’re monetizing you.

Spot Bitcoin ETFs like BlackRock’s IBIT and Fidelity’s FBTC are inflow traps. They provide an exit ramp for whales and early holders—just like the ICOs and meme coins of cycles past.

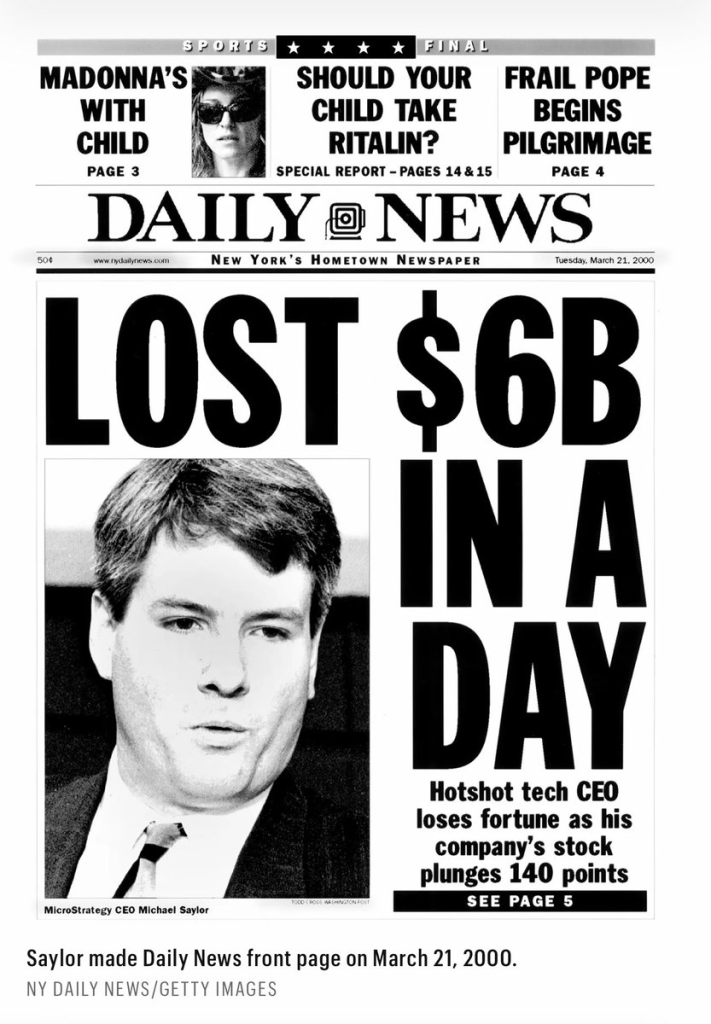

Then there’s Michael Saylor—Bitcoin’s top evangelist and bagholder-in-chief. His history is worth acknowledging, it could be rhyming:

“We are a large information refinery. We extract the value into an elixir.” — Michael Saylor, 2000 (shortly before MicroStrategy (MSTR) stock crashed 99%)

“We are a Bitcoin treasury company. We’re powered by a Bitcoin reactor.” — Michael Saylor, 2024

MicroStrategy is now a leveraged Bitcoin bet wearing an enterprise software mask. Its stock is up—but only because it’s riding Bitcoin’s coattails. If BTC drops 50%, MSTR implodes. Again.

Final Word

Yes, people are making money from Bitcoin—just like in every mania.

And while holding through the years has seen wallets in profit, what is the grand plan—hold forever? With those who do sell, for every well-timed exit there are thousands of wrecked portfolios. Data from Glassnode shows that over half of Bitcoin holders were underwater in 2022. And they will be again.

Bitcoin might not be the financial evolution it is now sold as. It’s more financial musical chairs. And eventually, the music stops. At some point, Michael Saylor will blow a huge hole in Bitcoin. Blackrock, too. The question then will be, can it recover?